YFSwap All-In-One DeFi Platform

YFSwap All-In-One DeFi Platform

DeFi is currently the subject of discussion in the crypto world, marking a new era for liquidity mining.

What is DeFi?

DeFi, simply means Decentralized Finance, it was developed to transform the centralized through liquidity mining.

DeFi market has grown exponential within the last six months. Many DeFi projects price has double and some triple their prices within short period due to the higher profits returns they promised. For instant, Synthetix Network Token market price has risen more than 20 fold, and Aave by 200-fold. A new platform have been developed to rivalry the market leaders such as Uniswap, Compound, Aave and JustSwap to mention but few, this new platform is called YFSwap.

WHAT IS YFSwap?

YFSwap is a DeFi protocol developed to helps users move their assets between different liquidity pools. In other words, YFSwap is a decentralized ecosystem that aggregates loan services. YFSawp automates it platform and resolve all the complexity behind yield farming and is managed by holders of its native governance token.

With the new era of Defi, YFswap was built on the foundation of Uniswap by introducing two tokens called YFETH and YFBTC.

YFBTC and YFETH

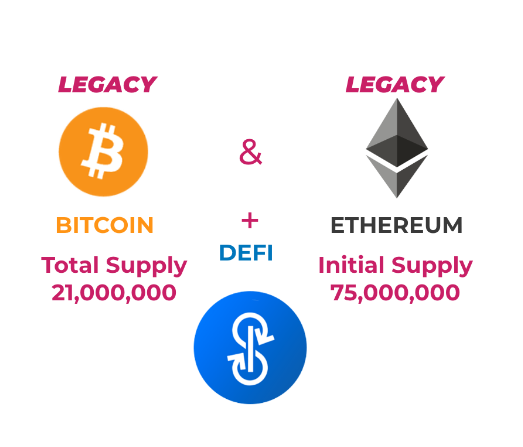

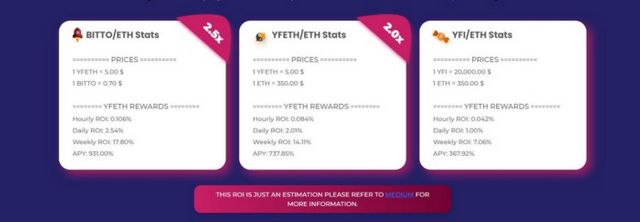

Both YFBTC and YFETH pools are created to replicate the success of #BTC and #ETH yet with 1000x lesser coin supply than the BTC and ETH, meaning 21,000 YFBTC and 75,000 YFETH. No matter what happen, the supply of both will never be increase from the currency more than 21,000 and 75,000 respectively.

Rather than mining, users can now be able to add to the liquidity of #YFBTC and #YFETH while earning rewards in returns. Users can mine #YFBTC via #BTC and YFETH with #ETH.

YFBTC

YFBTC is the first yield farming developed on BTC. Bitcoin is the underlying asset for YFBTC liquidity pool. YFBTC was issued in the same way as YFI. The market price of Bitcoin, is directly affecting the price of YFSwap liquidity. The YFSwap token version of Bitcoin YFBTC is also used for staking and provides liquidity.

YFETH

ETH is the underlying assets of YFETH pool. Users, who provide liquidity using YFETH pool, will still receive bonus even after existed from providing liquidity. However, the YFETH is entitled to holders of YFETH, but all users of the platform will receives small amount of fees generated from trading fees, even the user are no longer involved in providing liquidity again.

Future Hot Farming Options

YFTRX and YFDOT are the possible yield farming pool to be release by YFSwap.

TOKEN ECONOMIC

The YFSwap liquidity pool YFBTC and YFETH are 1000 times lesser than both Bitcoin and Ethereum. If the price of BTC rises by a dollar, the corresponding YFBTC will rise by a hundred dollar. After the crowdfunding, all the remaining YFETH will be burned and it will have Genesis rewards in the first month.

CONCLUSION

Blockchain technology and smart contract have created many investments and business opportunities in the world. Crypto-investors and traders are busy making huge profits as these opportunities present themselves. YFSwap, through it yield farming is also offering investors an opportunity to earn higher APY return on their investment. Please don’t miss this opportunity.

Useful links to the project

Website: https://www.yfswap.finance/

Twitter: https://twitter.com/yfswap

Telegram: https://t.me/yfswap

Medium: https://yfswapfi.medium.com/

Github: https://github.com/abanshinoburu

AUTHOR

Bitcointalk Username: Ibrahim Imran

BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=2852250

Comments

Post a Comment